Nicotine as a Service (NaaS)

PMI used R&D to become a better nicotine company. Healthcare M&A could lead to distraction.

PMI CEO Jacek Olczak and Chairman (and former CEO) André Calantzopoulos are gradually reshaping PMI from a simple seller of cigarettes into a drug delivery company specializing in nicotine.

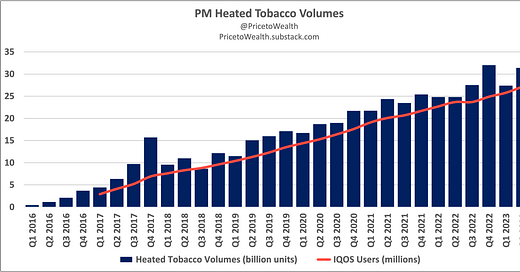

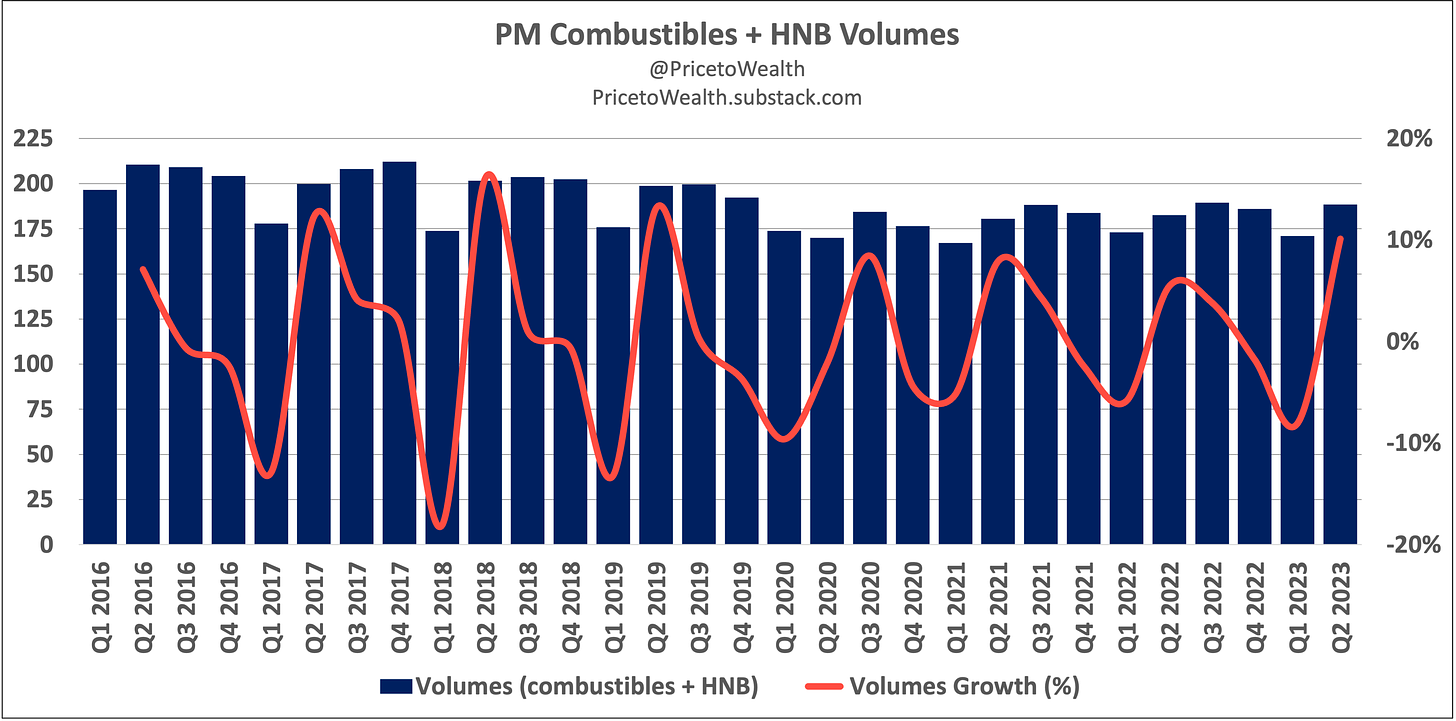

Management is laser-focused on transforming the company into a provider of smoke-free products. In the CEO’s own words: “We continue to make exciting progress on our smoke-free transformation, with smoke-free products accounting for almost one-third of PMI’s total net revenues in 2022.” The company’s heat-not-burn products (HNB) have taken off in Europe and Asia.

PMI’s smoke-free business rests on five distinct product “platforms.” Each platform represents a smoke-free nicotine delivery method.

Platform 1. Heating tobacco with a blade or via induction heating to produce an inhalable smoke-free aerosol. PMI’s heat-not-burn technology heats tobacco enough so that it releases the flavor and nicotine that naturally occurs in tobacco while reducing exposure to the tobacco stick’s toxins by 90-95%. No combustion takes place, so neither smoke nor ash is produced. Products using this method are IQOS, BONDS, and ILUMA.

Platform 2. Heating tobacco using pressed carbon to produce an inhalable smoke-free aerosol. No combustion. For the time being, management has canceled commercializing this technology due to consumer testing feedback.

Platform 3. Aerosolizing nicotine powder for inhalation using a non-electric device. No combustion. Still a work in progress (no commercialization yet).

Platform 4. Devices that produce an inhalable aerosol by vaporizing tobacco-free liquid. No combustion. Products using this method are BIDI and VEEV.

Platform 5. Snus and nicotine pouches. Snus is dried loose tobacco (i.e., snuff) which is consumed through the nose or mouth (between the lip and gum). Snus pouches contain a combination of shredded tobacco, water, salt, and flavoring. Nicotine pouches, on the other hand, contain pharmaceutical-grade nicotine derived from tobacco, cellulose, and flavoring. PMI’s most popular Platform 5 product is ZYN.

While growing share and raking in profits from its cash cow cigarettes business, PMI made a series of acquisitions in 2021 which led to the launch of the company’s health and wellness business. Management plans to use this new venture to develop healthcare products that will drive growth “beyond nicotine.”

Acquisition of OtiTopic

In August of 2021, PMI acquired OtiTopic, an inhaled drug specialist.

OtiTopic developed a dry powder of aspirin that heart attack patients could inhale. The drug would enter the respiratory system via the lungs and hit the bloodstream in under two minutes. In contrast, oral aspirin takes twenty minutes to enter the bloodstream. Otitopic’s product is a non-invasive, heart-specific therapy designed to quickly inhibit platelets in those experiencing heart attacks, but it has struggled in clinical trials. The method of delivery here aligns with Platform 3.

Acquisition of Fertin Pharma

In September of 2021, PMI acquired Fertin Pharma, a contract development and manufacturing organization (CDMO) specializing in oral drugs. Fertin develops and manufactures tablet, gum, lozenge, and pouch powder products with applications that include nicotine and cannabinoids but also vitamin and energy supplements, oral care, pain management, and sleep. The method of delivery here aligns with Platform 5.

Acquisition of Vectura

Also in September of 2021, PMI acquired Vectura, another inhaled drug specialist (also a CDMO), best known for working with Big Pharma to commercialize inhaler products. Vectura has mastered the process of bringing inhaled drugs to market. The company has three core competencies:

Drug development. Formulating drug therapies, conducting pharmaceutical analyses for regulatory submissions, and choosing the right inhalation device for the proposed drug (the company has a selection of proprietary inhaler and nebulizer technologies to choose from).

Manufacturing. Scaling a product up from the lab to commercial viability via the company’s contract manufacturing capabilities.

Regulatory approval. Vectura has substantial in-house expertise in navigating the requirements imposed on the inhaled medicine industry by regulatory organizations all over the world. Some of the products developed and manufactured by Vectura are prescribed to treat diseases that result from cigarette use.

Post-acquisition, PMI combined Vectura with Fertin Pharma, forming a new company called Vectura Fertin Pharma. Per the 2022 annual report, the new business is focused on developing inhalable and oral products that “have a net positive impact on society.” PMI reports the operating results of this business under a new segment called “Wellness and Healthcare.”

So, in addition to milking its lucrative cigarettes business and growing its smoke-free nicotine business, management is now also focused on developing and distributing non-nicotine healthcare products to consumers.

Shareholders would probably be better off if management did not pursue plans to develop non-nicotine healthcare products. Since 2009, management has spent $6 billion on R&D. The result has been a series of very commercially successful inhaled nicotine products. If the purpose of PMI’s $2-3 billion acquisition spree on Otitopic, Fertin, and Vectura was to add to its nicotine tech and talent stack, that might be fine. But launching a money-losing business unrelated to nicotine could turn out to be a costly distraction. Instead, capital might be better spent on share repurchases and paying out dividends. The future of this company should not depend on aspirin inhalers and COPD nebulizers.

Acquisition of Swedish Match (and AG Snus)

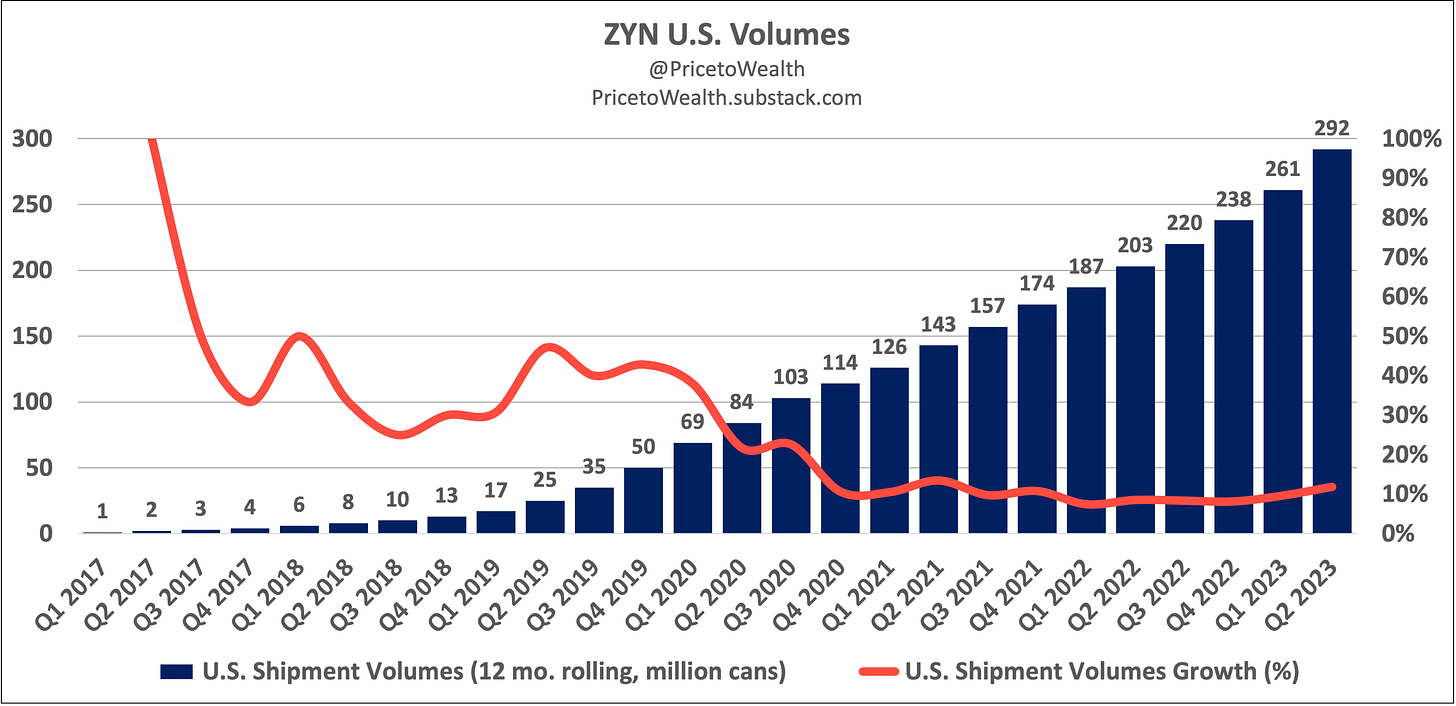

Following its acquisition of Danish snus manufacturer AG Snus in 2021, PMI purchased Swedish Match in November of 2022. The acquisition gave PMI the world’s number one nicotine pouch brand (ZYN) and a retail distribution network in the U.S. rivaling that of Altria.

Acquisition of U.S. IQOS Rights

In October of 2022, PMI bought back from Altria the rights to commercialize IQOS in the U.S. starting in 2024. It is expected that PMI will plug its lineup of IQOS products into Swedish Match’s retail distribution network in the U.S.

Altria-PMI Merger Chatter

There has been some talk about PMI potentially merging with its former parent company. In 2020, the two companies discussed the possibility of recombining, but PMI management backed away from the idea.

Thanks for reading.

Other pieces in this series on PMI:

This piece is for informational purposes only. You should not construe anything herein as investment, financial, legal, tax, or other advice. Nothing contained in this piece constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments.

All content in this piece is for general informational purposes only and does not address the circumstances of any particular reader. Nothing in this piece constitutes professional and/or financial advice, nor does it constitute a comprehensive or complete statement of the matters discussed. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this piece before making any decisions based on such information or other content.

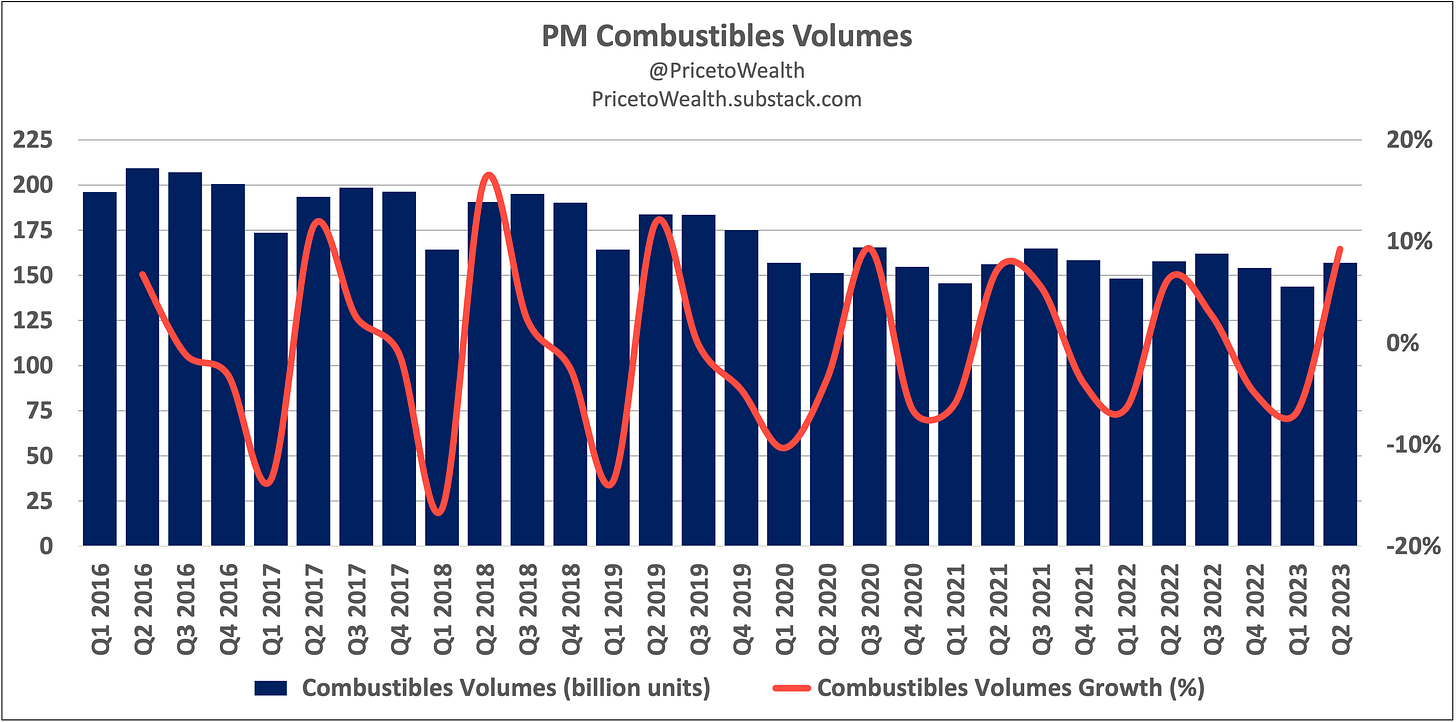

Great graphs as usual, thanks! I have been looking forward to your combined Cigs+HNB volume chart. (Too bad that cigarette and IQOS volumes can't be reasonably combined with Zyn volumes for the ultimate volume chart, right?)

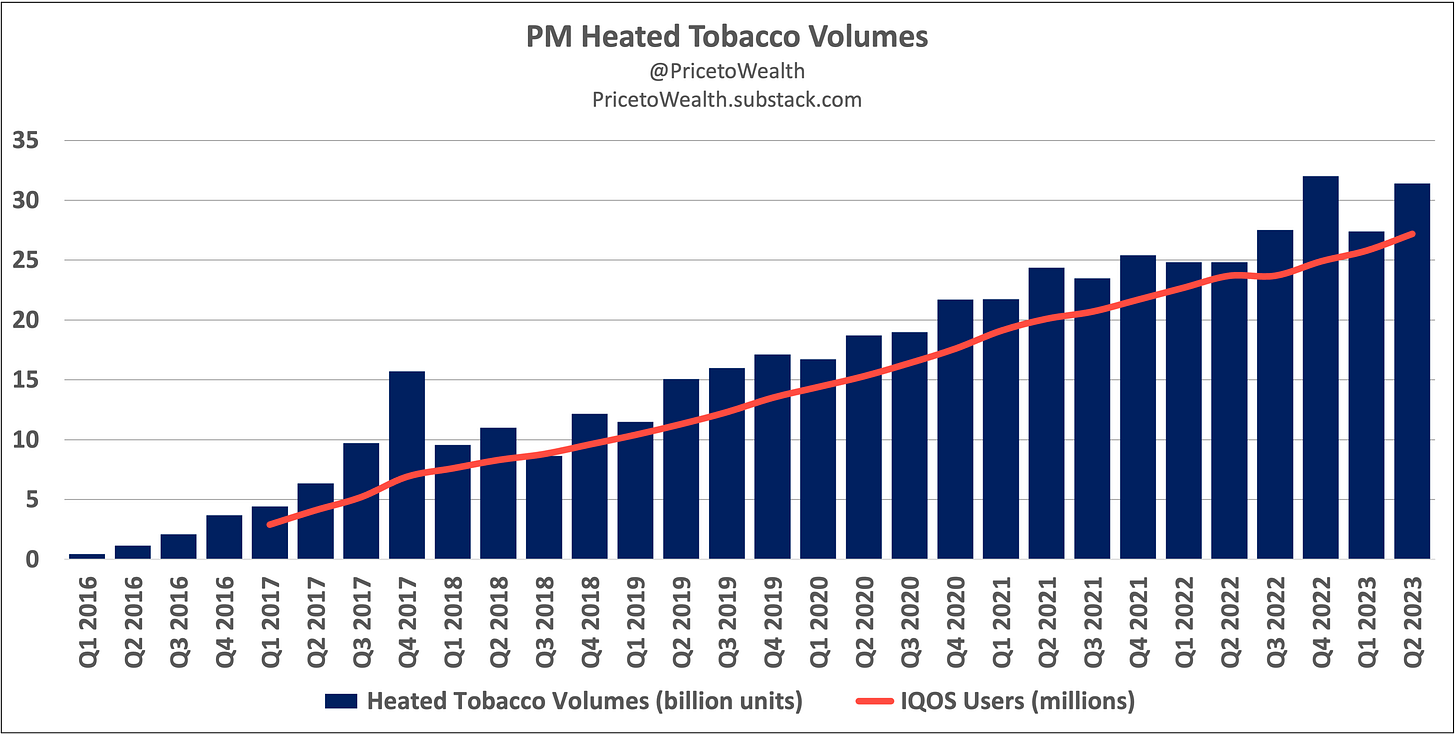

I wonder how would the charts would look like if the volume growth rates (for combustibles and combustibles+HNB) were plotted YoY instead of QoQ to get rid of the cigarette's yearly seasonality.

I totally agree that the pharma acquisitions were (and continue to be) knowable mistakes for the company. At the end of the day, PMI is a producer of recreational nicotine products. Just having an expertise on indigestible liquids wouldn't make the Coca-Cola Company a prime candidate for expanding into drinkable pharmaceuticals.