In December of 2023, British American Tobacco wrote down much of the value of its U.S. cigarettes business in the form of a $31.5 billion non-cash impairment. Starting in 2024, management will treat some of its U.S. cigarette brands as assets with a lifetime of thirty years. Affected brands include Newport, Camel, American Spirit, and Pall Mall.

To be clear, leadership believes cigarettes will still be around in thirty years, but it doesn’t believe that some of its major brands will last indefinitely. So management is opting to amortize some of the value of its major brands over three decades. If BTI were to sell its U.S. business to a buyer (like Altria) at a loss, the company could realize some tax benefits. Otherwise, the write-down does not provide a benefit to the company (aside from keeping the company in compliance with accounting standards). (March 2024 update: BTI announced plans to sell part of its ITC stake. Any taxable gains there could be offset by the write-down on its U.S. cigarettes business).

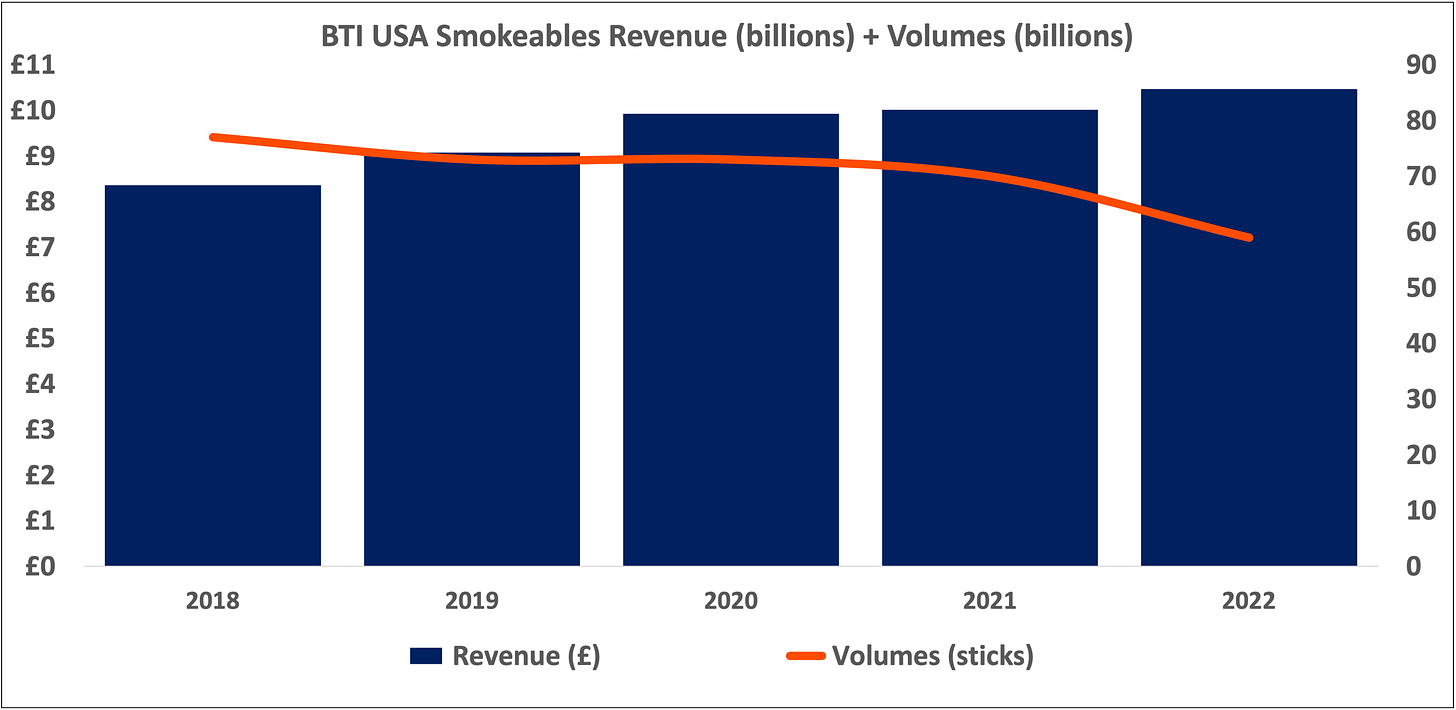

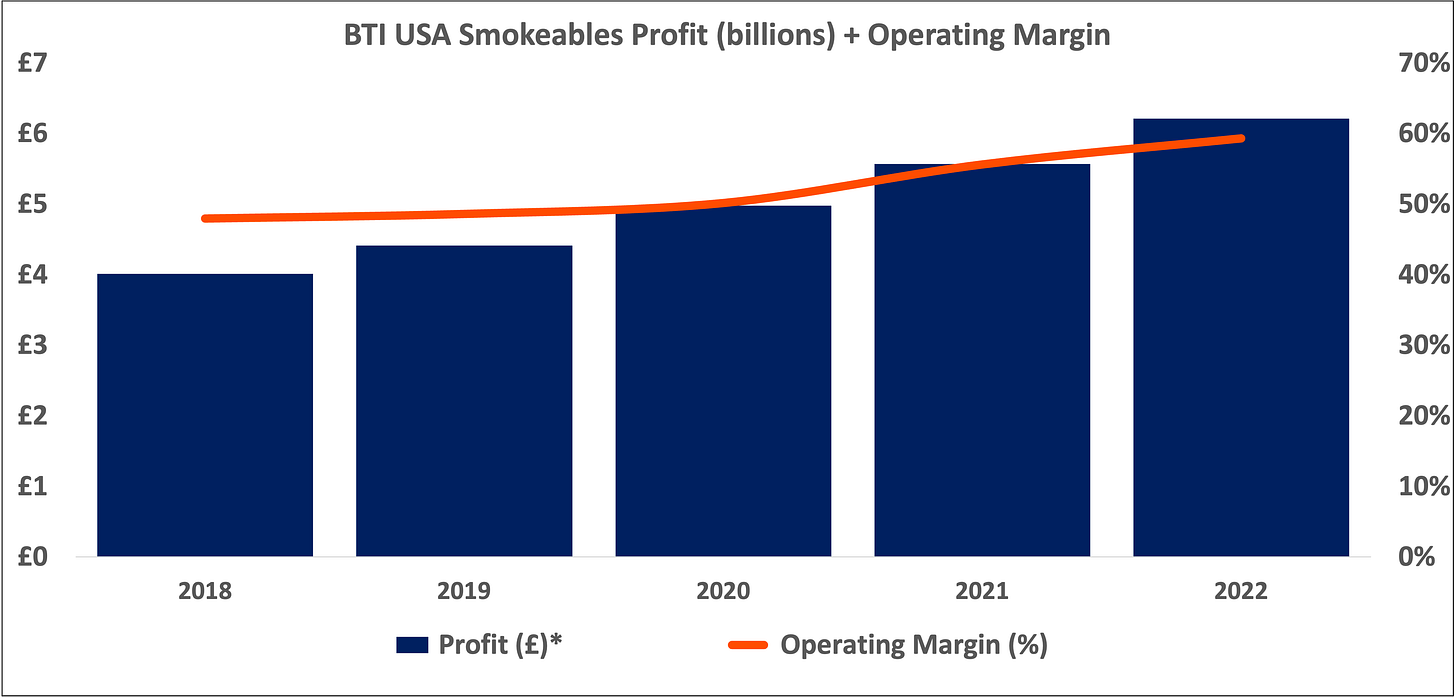

While BTI’s U.S. cigarette volumes have fallen 25% between 2018 and 2022, its U.S. cigarette revenue is up 25%, profit is up 55%, and operating margin is up 24% over the same timeframe.

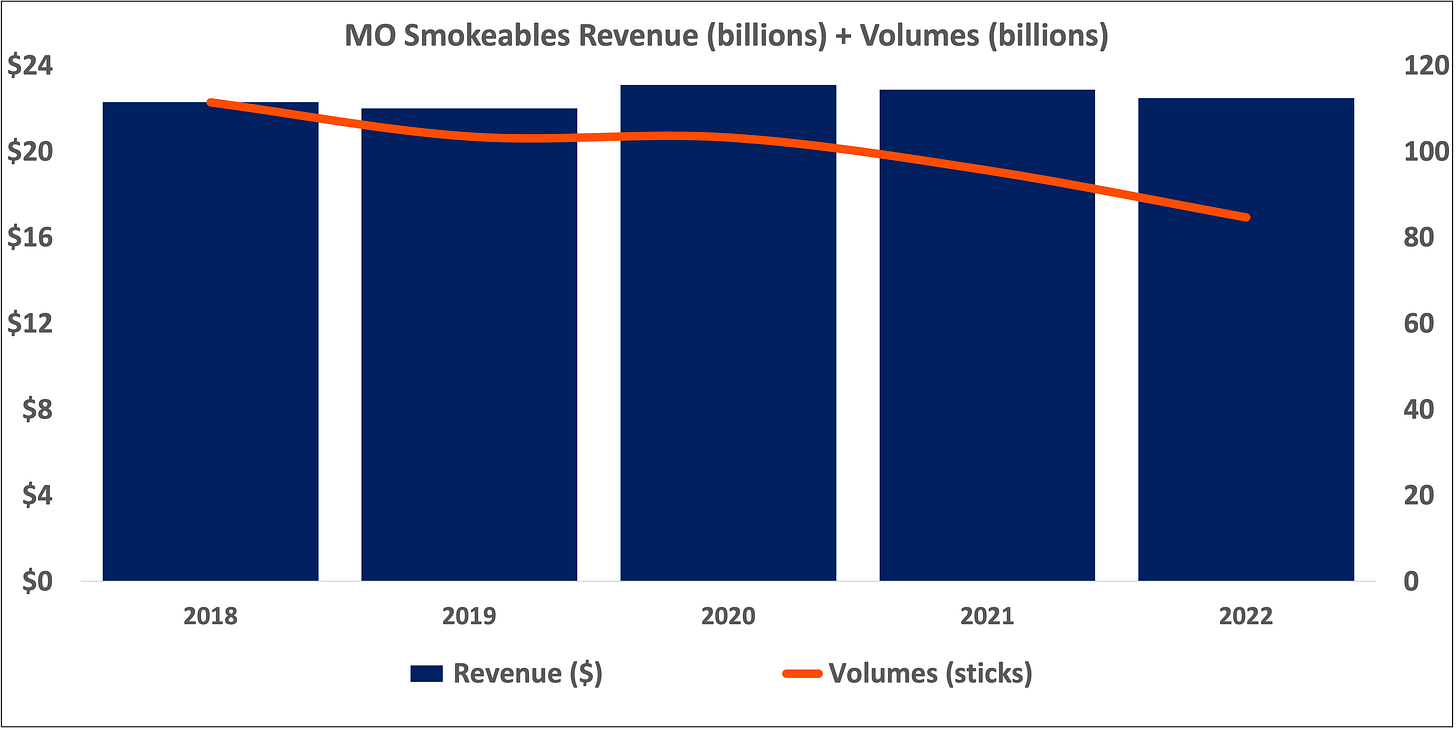

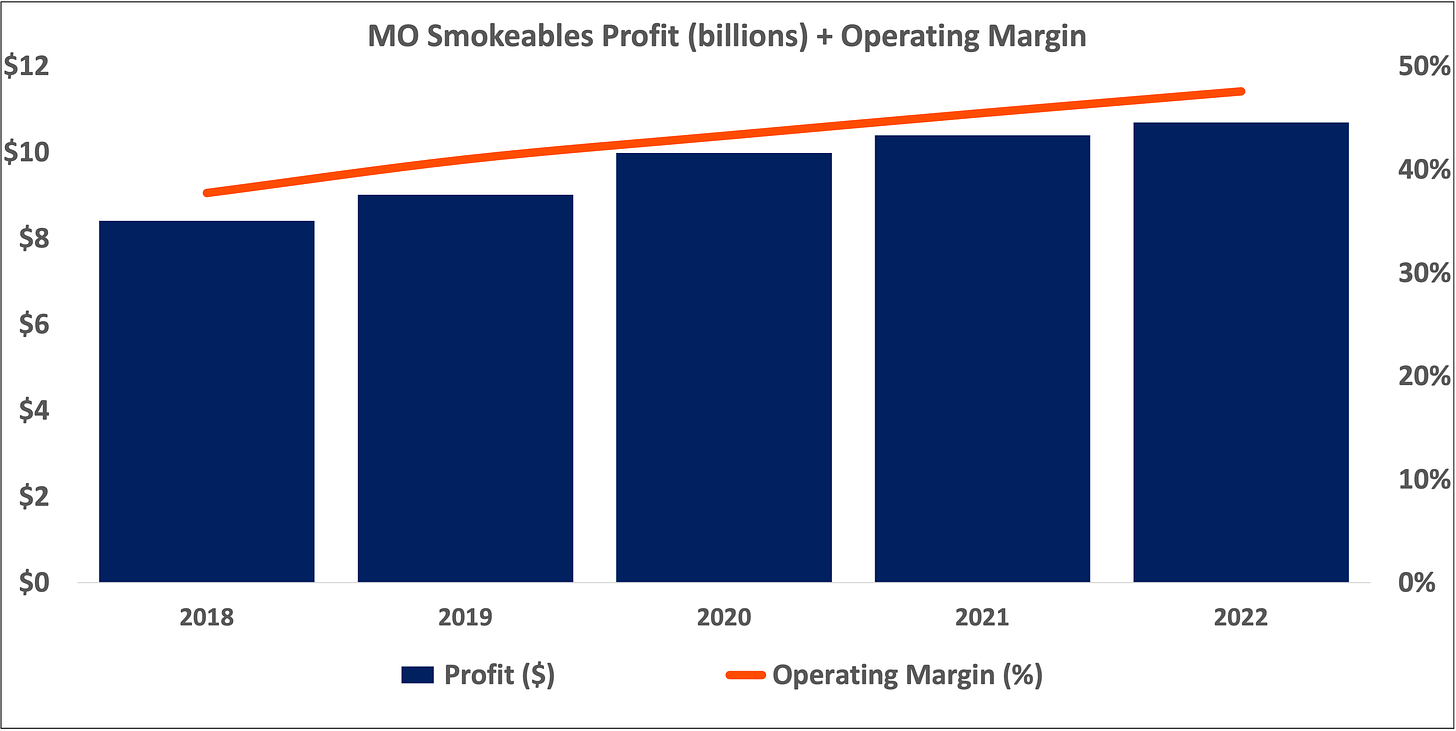

Altria — BTI’s competitor in the U.S. — has also put up decent numbers over the same period. Despite its cigarette volumes dropping 24% between 2018 and 2022, its cigarette revenue has held steady with profit and operating margin both increasing by over 25%.

Altria’s cigarettes business from 2009 to 2022 shows the same trend of increasing profitability as volumes fall.

Despite its free cash flow, free cash flow margin, and dividend all roughly doubling or tripling between 2009 and 2022, Altria’s shares today trade at around the same price as they did in May of 2014. Moreover, Altria’s price-to-free-cash-flow multiple has halved since 2014, and its dividend yield has just about doubled.

Thanks for reading.

Other pieces on Altria:

This piece is for informational purposes only. You should not construe anything herein as investment, financial, legal, tax, or other advice. Nothing contained in this piece constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments.

All content in this piece is for general informational purposes only and does not address the circumstances of any particular reader. Nothing in this piece constitutes professional and/or financial advice, nor does it constitute a comprehensive or complete statement of the matters discussed. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this piece before making any decisions based on such information or other content. Neither the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.

Hi, I tapped IR on the impairment charge and its implications, specifically taxes.

In my first mail I asked (but it was badly worded): "And then, my second question, does the amortisation of these intangible assets over the next 30 years reduce taxable income by the same amount each year, thus reducing taxes to be paid, thus increasing free cash flow?"

And to this I got the response: "The US brand impairment / amortisation is not expected to impact ongoing corporate income tax payments in the USA."

Then I summarised their entire answer to my first mail (which included another question still) and asked them to either kindly confirm or disconfirm, to make sure I understood them correctly. Here's my summary: "The impairment is taken against the US brands (wherever they are sold); the impairment reduces the carrying value of the brands from roughly 78bn to 53bn. The remaining value of 53bn will be amortised over the next 30 years. This amortisation process will in no way reduce taxes BAT will have to pay either in the USA, in the UK at home, or wherever."

And here's their answer: "Yes, that is a great summary. One clarification, not the full 25bn will be allocated against the brands but the majority will be with some remainder against goodwill. Further details will be given in February."

So here we have it, according to IR, there's no beneficial effect on taxes coming from that amortisation.

Or is it possible that the person dealing with my request at IR was just ill-informed ?