The GEO Group: Beyond Private Prisons

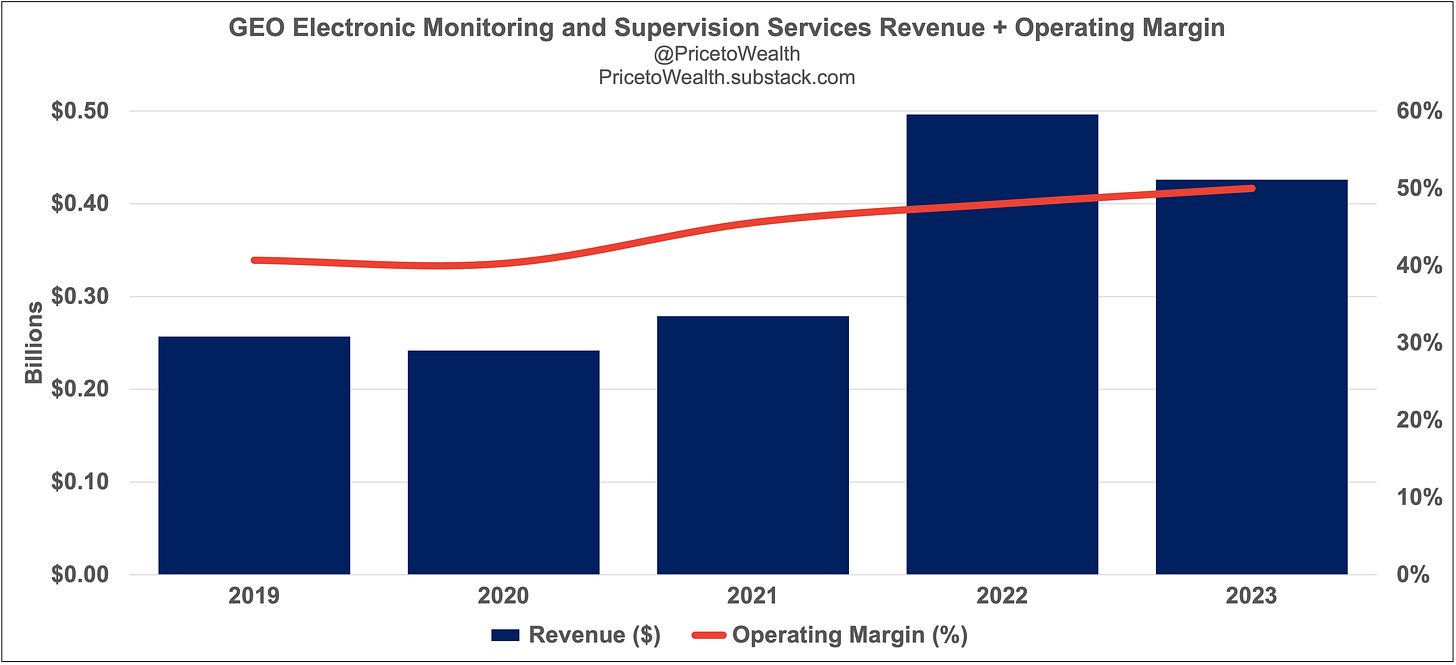

Electronic Monitoring and Surveillance Services generated $213 million in operating income at a 50% operating margin in 2023.

The GEO Group is best known for operating private prisons in the United States, Australia, South Africa, and the United Kingdom. The company manages approximately 81,000 beds at 100 facilities.

Some of these facilities provide reentry and electronic monitoring and supervision services for hundreds of thousands of individuals. The company uses radio and GPS technology to monitor curfew and house arrest compliance — and alcohol monitoring devices to make sure offenders don’t drive under the influence again. GEO designs and manufactures these compliance devices which it sells to and administers on behalf of governments.

GEO operated as a REIT from 2013 to 2020. As a REIT, GEO enjoyed significant tax benefits but was required to distribute at least 90% of taxable income to its shareholders. Management decided to abandon its REIT status starting in 2021 so that it could freely allocate free cash flow toward reducing debt, paying dividends, buying back shares, and/or reinvesting in its businesses. Regarding GEO’s decision to de-REIT, CFO Brian Evans said, “We’re looking at what’s the best use of the company’s cash flow going forward, where are we going to get the most value for the cash flow that we generate.” Accordingly, the board voted to stop paying a dividend and instead prioritize allocating GEO’s free cash flow toward reducing its debt.

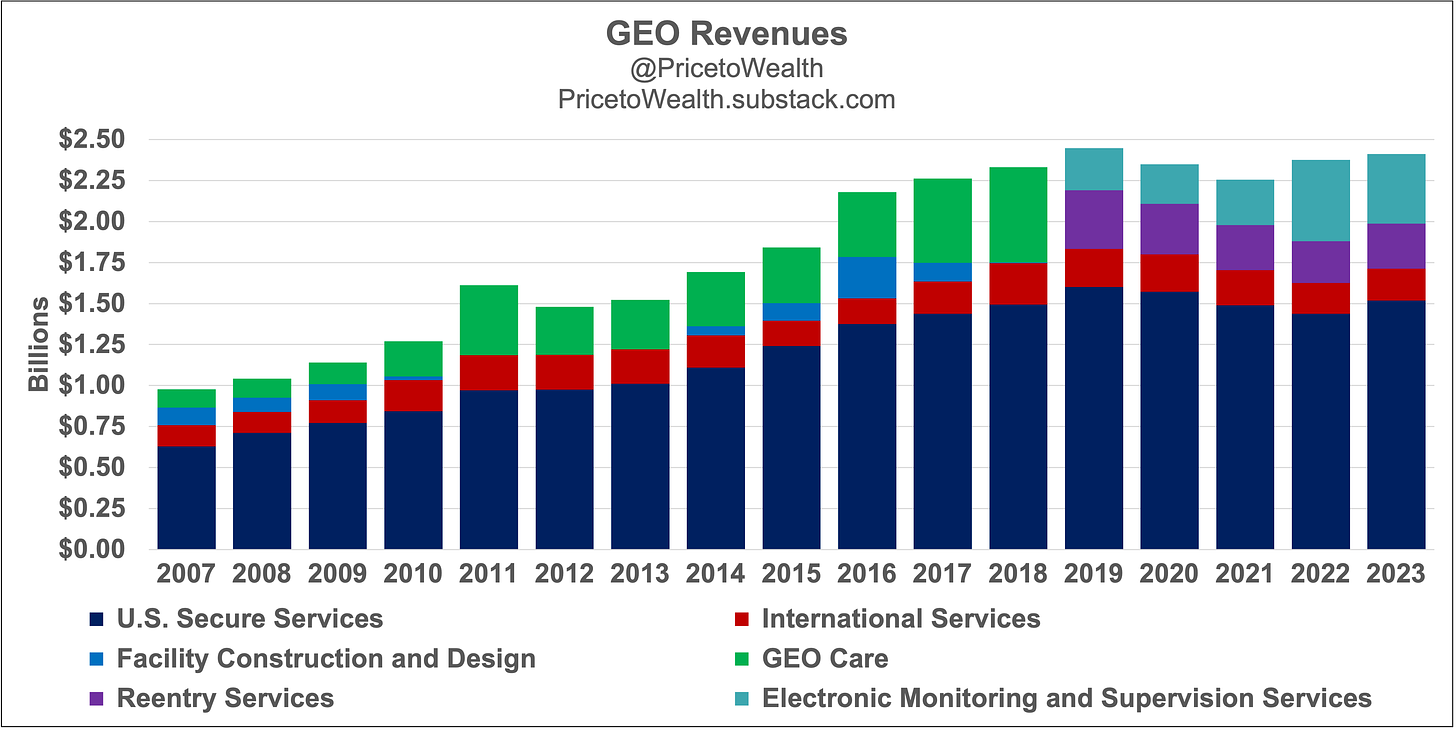

Between 2007 and 2023, GEO grew revenue 147%. Revenue per facility grew 46%.

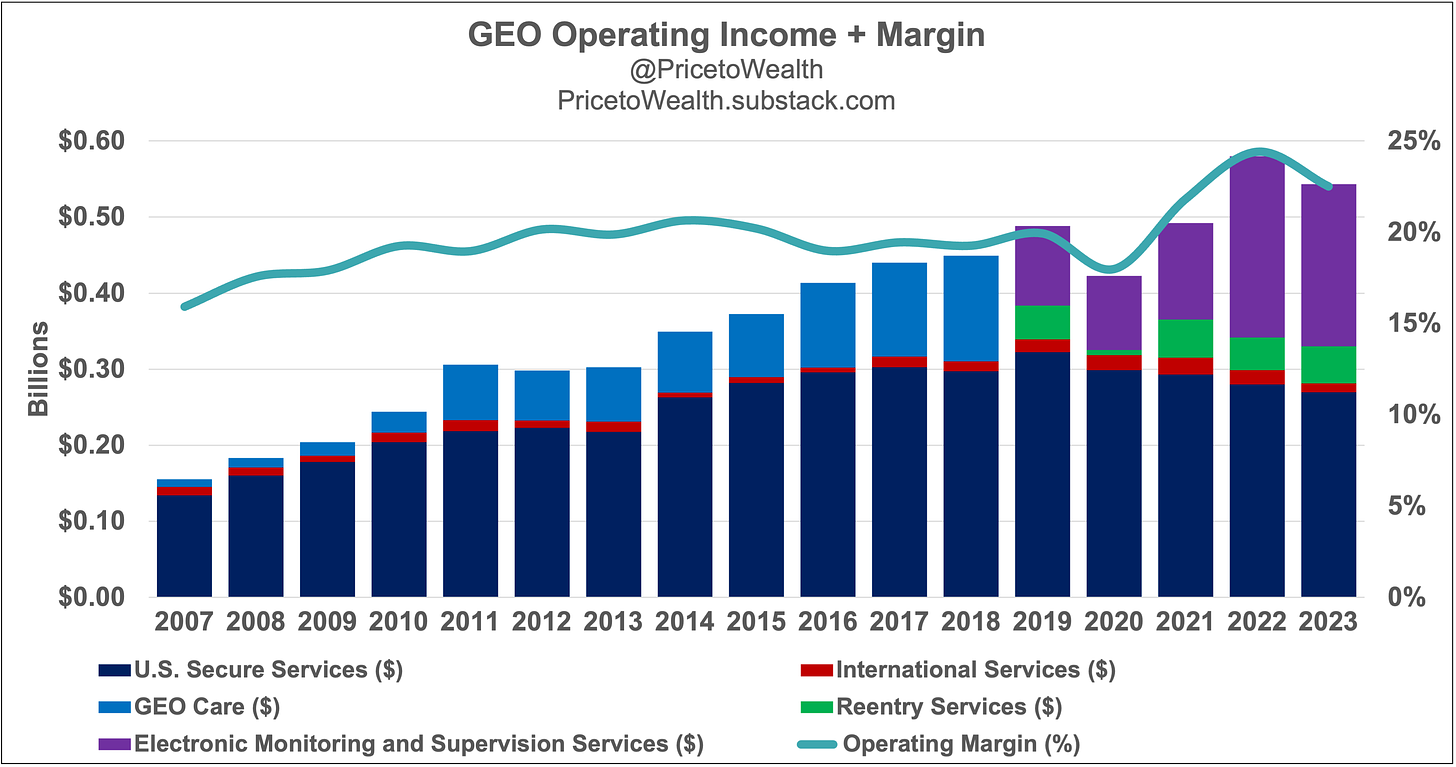

GEO’s largest business in terms of revenue and operating income is its U.S. Secure Services segment. That division owns and operates private prisons on behalf of U.S. states and the federal government. While its revenue and operating income are up 141% and 101% from 2007 to 2023, its operating margin has been trending down from almost 24% in 2014 to under 18% in 2023.

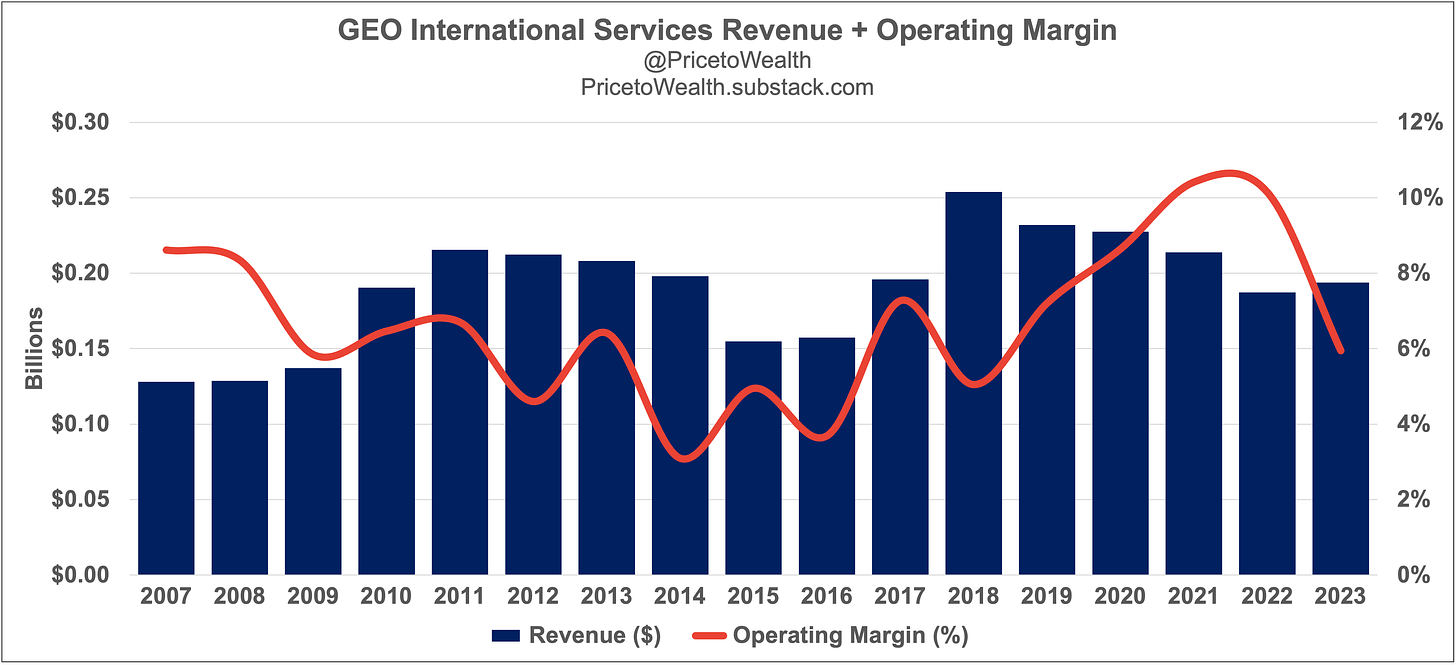

GEO’s International Services business (private prisons overseas) generates 13% and 4% of the revenue and operating income of its U.S. counterpart. Not only is it much smaller than the U.S. business, it’s much more volatile as well (in part because of currency exchange rate changes).

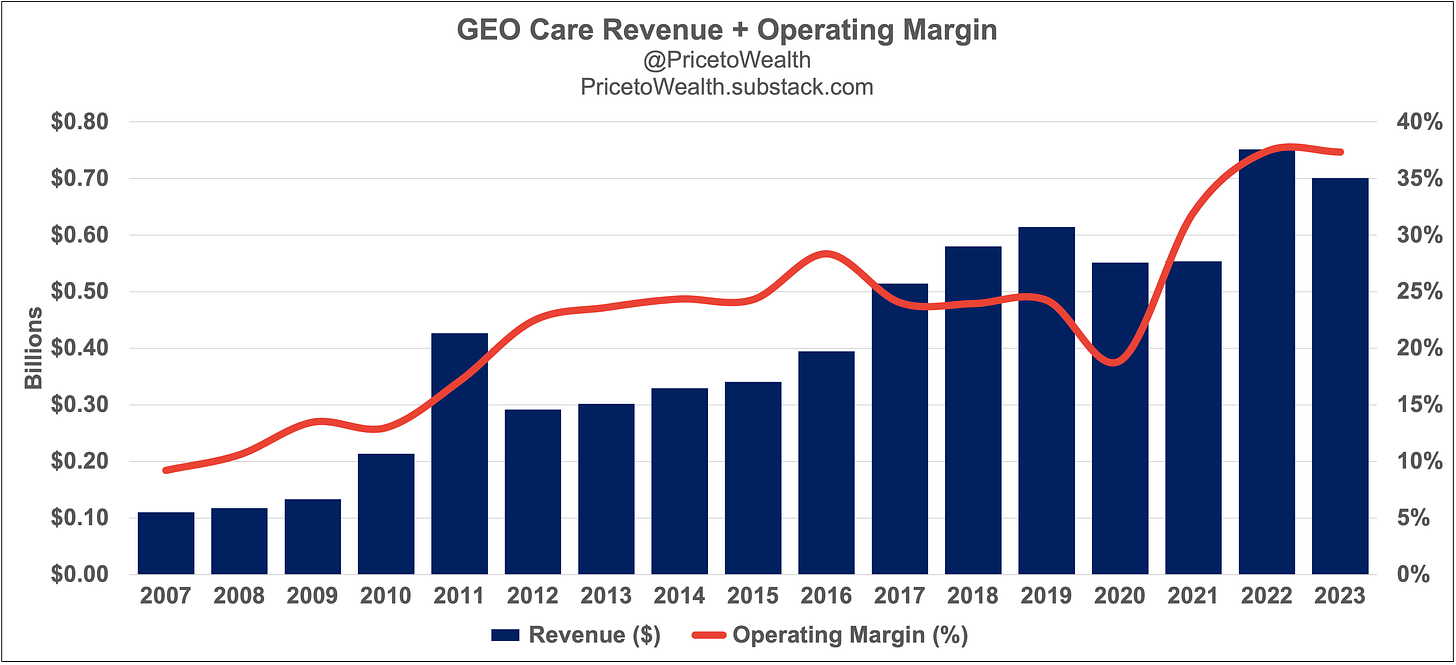

The GEO Care segment used to include both Reentry Services and Electronic Monitoring and Surveillance Services (EMS). Then, several years ago, GEO Care was renamed Reentry Services, and EMS became an independent reportable segment.

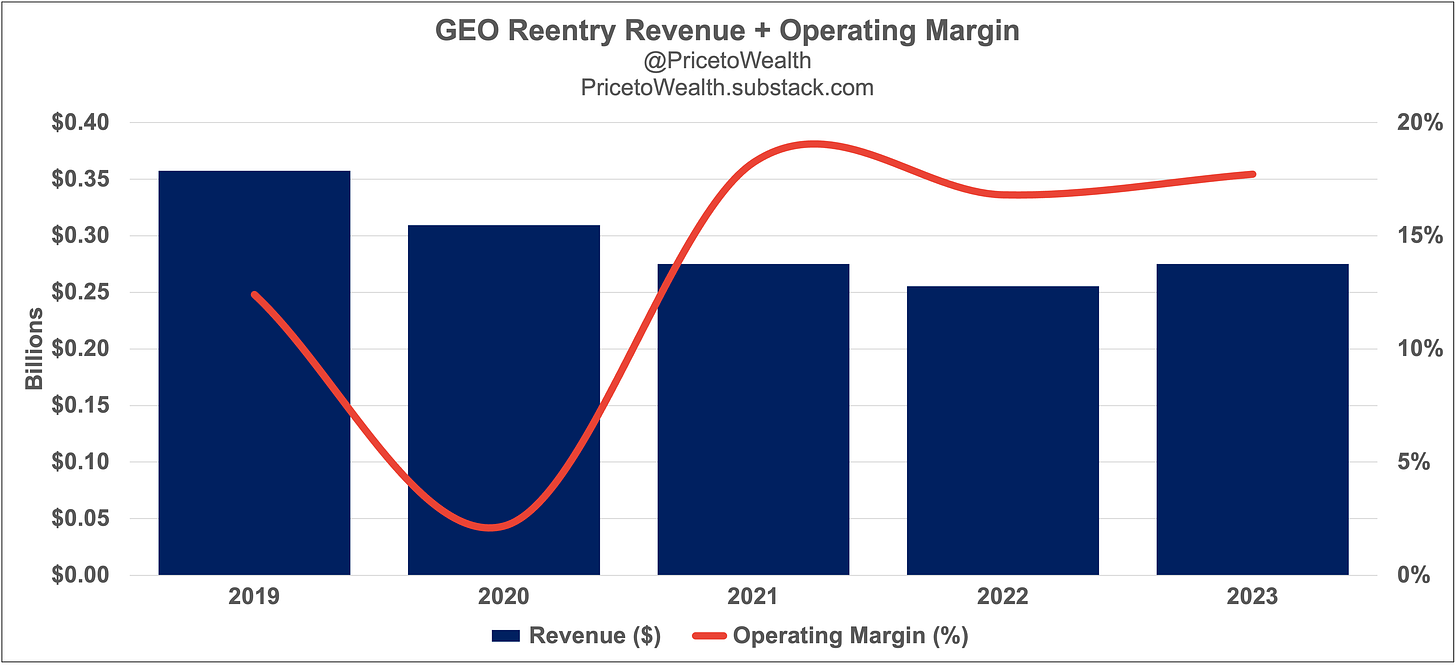

Reentry Services includes residential and non-residential treatment, educational and community-based programs, and pre-release and half-way house programs. The company supervises individuals in community-based programs and reentry centers, provides temporary housing, education, mental health services, and employment assistance to help those reentering society reintegrate with their communities after leaving prison.

While Reentry Services revenue fell 23% between 2019 and 2023, the segment’s operating margin has stabilized at around 17%. Operating income is up 10% over that timeframe.

EMS is GEO’s most profitable and fastest-growing segment with an operating margin of 50%. The business supervises hundreds of thousands of offenders and pretrial defendants (up from 70,000 in 2013), using radio frequency, GPS, and alcohol monitoring devices. It generated $213 million in operating income in 2023. By contrast, GEO’s U.S. prisons business (U.S. Secure Services) generated $270 million in operating income in the same year. Between 2019 and 2023, EMS revenue and operating income grew 66% and 104% while U.S. Secure Services revenue and operating income shrank 5% and 16%.

At the time of this writing, GEO’s market cap is $1.84 billion. The company’s facilities and land together are worth almost $2.5 billion. Why is the company’s real estate alone worth more than the entire company? Because the company’s long-term debt was $1.726 billion as of the end of 2023 (down from $1.933 billion in 2022). So GEO’s real estate and long-term debt are about 135% and 93% of its market cap.

By contrast, McDonald’s has a market cap of $204 billion, and its real estate holdings and long-term debt are each almost 19% of that.

Another comp: Waste Management’s market cap is $85 billion, and its property and equipment are worth 47% of that. Its long-term debt is almost 19% of its market cap.

Thanks for reading.

This piece is for informational purposes only. You should not construe anything herein as investment, financial, legal, tax, or other advice. Nothing contained in this piece constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments.

All content in this piece is for general informational purposes only and does not address the circumstances of any particular reader. Nothing in this piece constitutes professional and/or financial advice, nor does it constitute a comprehensive or complete statement of the matters discussed. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other content in this piece before making any decisions based on such information or other content. Neither the author nor any of its affiliates accepts any liability whatsoever for any direct or consequential loss howsoever arising, directly or indirectly, from any use of the information contained herein.